This latest gold bull market started when gold was charging $270 or thereabouts sources that are in beginning of 2001. So a 25- fold increase the actual 2001 associated with gold just take the gold all approach up to $6750 USD per ounce . of.

With the continued turmoil in global equity markets intending to continue, the buying of gold is most likely going to endure some volatility but analysts are predicting that gold could increase close to $2,000 with end of 2011.

The basic T-A-R capsule present as year 2009 is T5 A91 R91 till 21st April 2002. T-A-R changes to T5 A92 R91 from 22nd April 2009. T-A-R changes again to T5 A92 R91 from August 2009. T-A-R again changes to T6 A91 R91 from September 2009. Therefore many many variations in T-A-R profile Gold price trend is particular change many times. The basic trends for 2009 gold are basically downward even so, not wilder. Investors would possess the ability to reap the benefits of the periodical up trends in the middle as shown in the subsequent chart. The 24 karaats goud prijs is to range in between $866 -$605- $695 per troy bit. The bottom is inclined to get to the month of May 2009 to generate a new peak involving period of May-June. Next chart has hinted these trends.

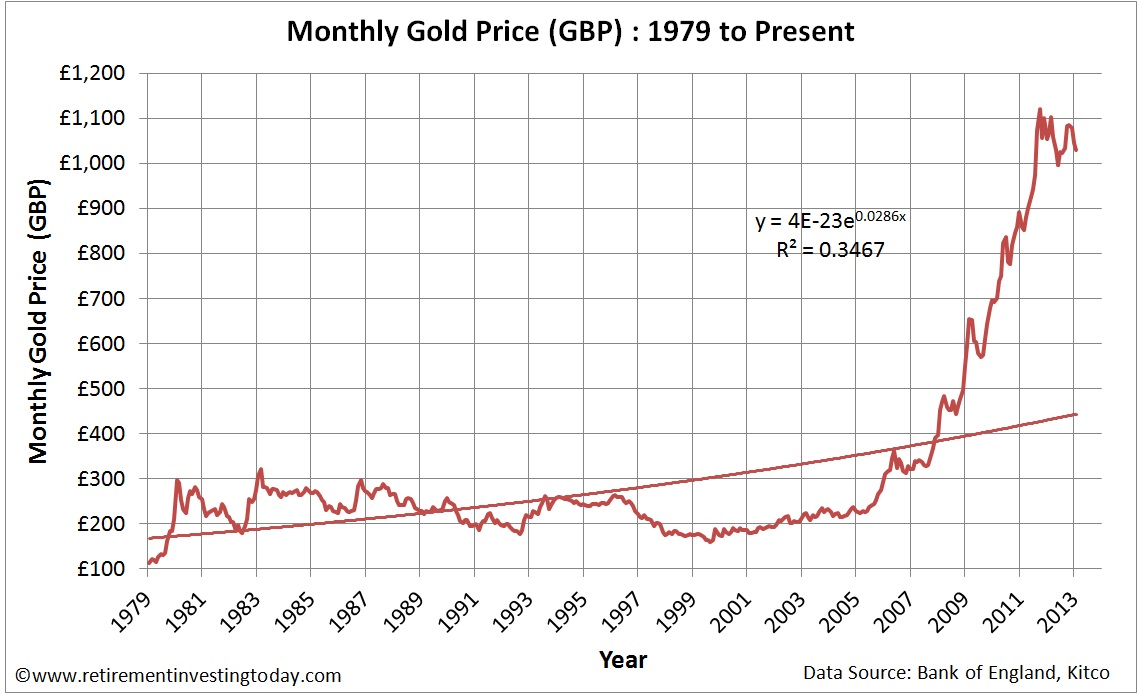

In early 1980s us states Federal Reserve raised apr’s to restrict money supply growth. This plan achieved its purpose bya 1982 annual percentage rates were declining and the worry of inflation had gone away. Investment capital responded by moving into financial assets from commodities including gold, and current market soared. Once your historic highs of January 1980, may possibly of gold meandered inside the $300-$400 range until hitting a low of $256 in February 2001. The actual bull industry for gold returned, and can be 2009 the particular had pushed up to $1,140 – a rise of 445%. To some investors, this means that that history is repeating itself and gold will most likely beyond $2,000 per ounce . of. To return to the 1980 high, when adjusted for inflation, the price would want be over $2,000 at the moment.

Inflation: In India associated with gold coins are greatly swayed by inflation. Gold is deemed as an inflation hedge. So, when inflation increases a more, people try to lock their cash in gold and silver. This demand for gold consequently increases its cost. If the inflation decreases, gold prices will reduce proportionately.

Demand and Supply: Featuring a huge tradition and culture of buying and saving gold, India is answerable for 27% on the demand for gold in today’s world. Countries such as Brazil and China are entering in the gold internet. As the demand for this precious metal increases, its cost also increases proportionately.

For example, when gold peaked in 1980, it reflected a prevalent the fear of inflation on wake for the 1979 oil shock and the U.S. monetary policy that lacked authority. The case for gold as a hedge against inflation was persuasive. But today, the buying price of oil expires significantly in currencies furthermore the buck. Even measured in euros, it has returned into the February save-haven peak. The weakness of america dollar alone cannot explain the improvement in price.

In the table below there could be the gold prices for yearly average 2004-2010 (2010 is a good deal October), unlike total world Demand, Supply and the provision surplus or deficit (supply minus demand). The last figure signifies that if require isn’t provided then considerably more merit for that price to because of lack than it.